Certainty Equivalent Calculation

Say, you just graduated from university. Thinking about a new startup and got an excellent idea. You have prepared a business plan. According to your plan, you need to invest 50,000$ in your business. Within a year, you can expect a profit of 400,000$. But there is a 50/50 chance that you may lose all of your investment money and gain nothing. Your business plan is so solid that, one of your friends proposed you buy out the business plan from you for 5,000$. The condition is that, you won't execute that plan, rather your friend will do that. Your friend will invest his money and take the risk. You simply get a certain 5,000$ for giving up the business opportunity.

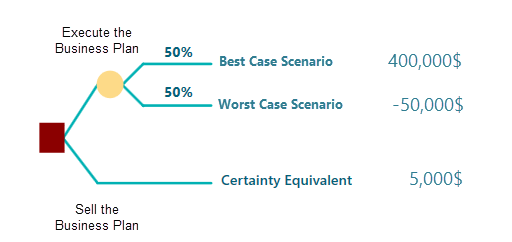

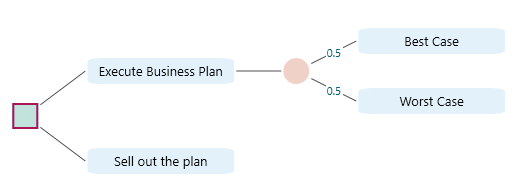

What do you think? will you give up the business opportunity for 5,000$? If yes, then, in the economics term, this 5,000$ is the Certainty Equivalent for this uncertain opportunity, as depicted by the following decision tree.

Therefore, Certainty Equivalent is the amount of money that is equivalent in your mind to a given situation that involves uncertainty (or risk). It is a guaranteed return that someone would accept, rather than taking a chance on a higher, but uncertain return.

A practical example of certainty equivalent is your insurance payment or extended warranty of something very expensive to repair. Say, you bought a used car and you are worried that if something happens to the car (engine or transmission break down) in the next 5 years, it can cost you 10,000$. The dealer is asking that, if you pay just 2,000$ to buy an extended warranty, then in those worst cases, they will cover the cost. Well, you are not sure if the car will definitely break down or not. If it won't break down, then, your upfront payment of 2,000$ will be certainly lost. But, if something breaks down that would cost 10,000$ to repair, then, your gain will be 8,000$ in that event. Obviously, it is like gambling. If you agree to pay that 2000$ to buy the piece of mind that, you are covered for that worst-case scenario, then your certainty equivalent for this gamble is 2000$.

Calculate Certainty Equivalent

Let's get back to your original business plan. Say, you are not convinced by the 5,000$ selling price of your business plan that your friend proposed. But you do not know exactly what should be the right price to sell out your business plan. Perhaps, you should ask for more than 5,000$? How can you figure it out? Is there any way to find that number mathematically?

We have learned that the utility function maps a real-world value to a satisfaction level. If you can model your utility function for monetary gain from a risky investment (like this one), then using that utility function, you can calculate your certainty equivalent.

Say, your utility function is U(X), where x is the real-world monetary gain from a risky investment.

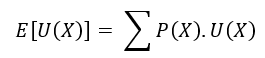

Based on that utility function, you can calculate the Expected Utility of the above investment. The expected utility of a random variable is basically the weighted sum of the utility value, where the weight represents the probability, as depicted by the following expression.

So, whatever is your utility function, you pass that real-world value 400,000 and -50,000 to your utility function. In that way, you will get a number for Expected Utility E[U(X)], as shown here.

Once you get the Expected Utility, you need to find the Inverse Function of your Utility Function.

If you are not familiar with Inverse Function, then here is the simplest explanation. Say, you have a function f(x) = y. For various inputs x, you get various outputs y, right? The inverse function of f(x) is a function that will find out, for what input value "x", you will get a given "y" value.

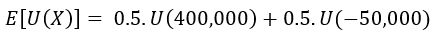

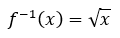

For example, if a function is  , then, its inverse function is

, then, its inverse function is  . So, if we want to find out, for what value of x, we can get f(x) or y = 9, then this inverse function can answer the question. If we plug in the value "9" to this inverse function, we get 3. So, now, we know, for input "3", we can get a value for f(x) = 9.

. So, if we want to find out, for what value of x, we can get f(x) or y = 9, then this inverse function can answer the question. If we plug in the value "9" to this inverse function, we get 3. So, now, we know, for input "3", we can get a value for f(x) = 9.

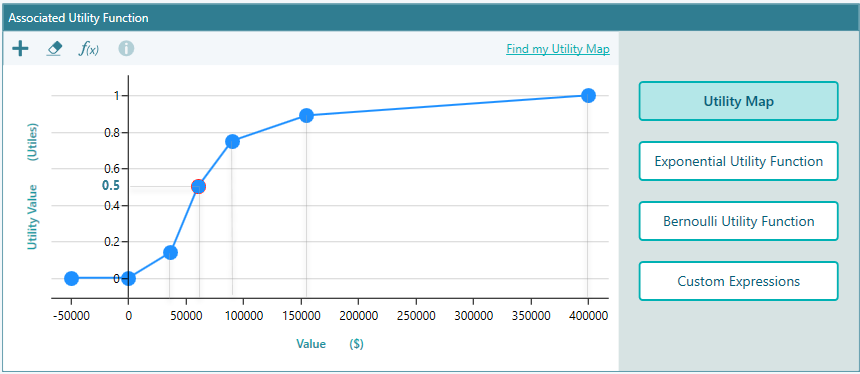

Ok, now, let's focus on our Expected Utility Function. The certainty equivalent is the inverse function of the Utility function where the value of X is equal to the Expected Utility. If the Certainty Equivalent is denoted by CE, then,

A Visual Demonstration

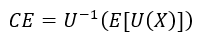

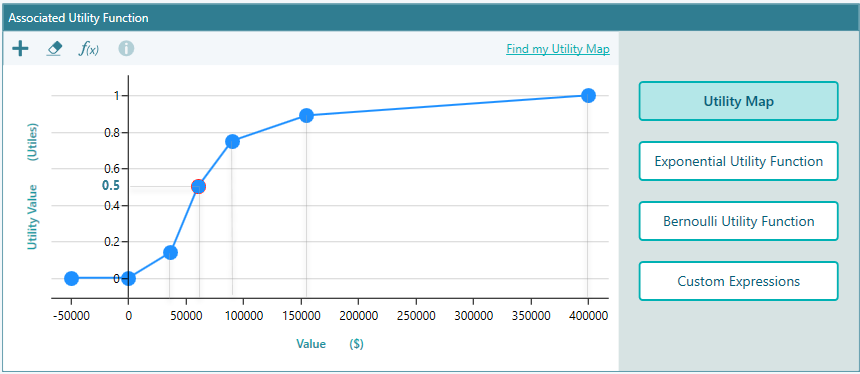

Let's say, you have modeled your utility function like this:

If you are familiar with the SpiceLogic Rational Will or the Decision Tree Software, then, you will be able to create such utility functions very easily. The above screenshot is taken from the SpiceLogic Decision Tree software.

According to the above-modeled Utility Function plot, we find:

U(400,000) = 1.

U(-50,000) = 0.

Expected Utility, or EU = 1 * 0.5 + 0 * 0.5 = 0.5

Certainty Equivalent, or CE = U-1 (EU) = U-1 (0.5)

Now, from the above chart, we can easily see that, for the Utility function's input value of around 60,000$, we get the utility function value = 0.5. So, we get,

U-1 (0.5) ≈ 60,000$

So, your Certainty Equivalent for this uncertain investment should be 60,000$, not 5,000$. You should ask 60,000$ for your friend for selling out the business plan according to the given utility function.

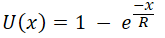

If your Utility Function is a defined mathematical function whose inverse function is also a mathematical function, then it can be easy to derive a function for Certainty Equivalent. For Example, if your utility function is an Exponential Utility Function like this:

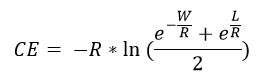

Where R is the Risk Tolerance, x is a random variable for Payoff. Then, say, in a given investment or Lottery, you can win 'W' with 0.5 probability, and you can lose 'L' with 0.5 probability.

Then, using the Inverse function, the Certainty Equivalent can be derived as

But, don't worry about any of these computations when you have our Decision Analysis Software (Decision Tree Software or Rational Will) as the software will do all the calculations for you seamlessly by using all the input taken from you as explained in the following sections.

Using the Decision Tree Software for Certainty Equivalent Calculation

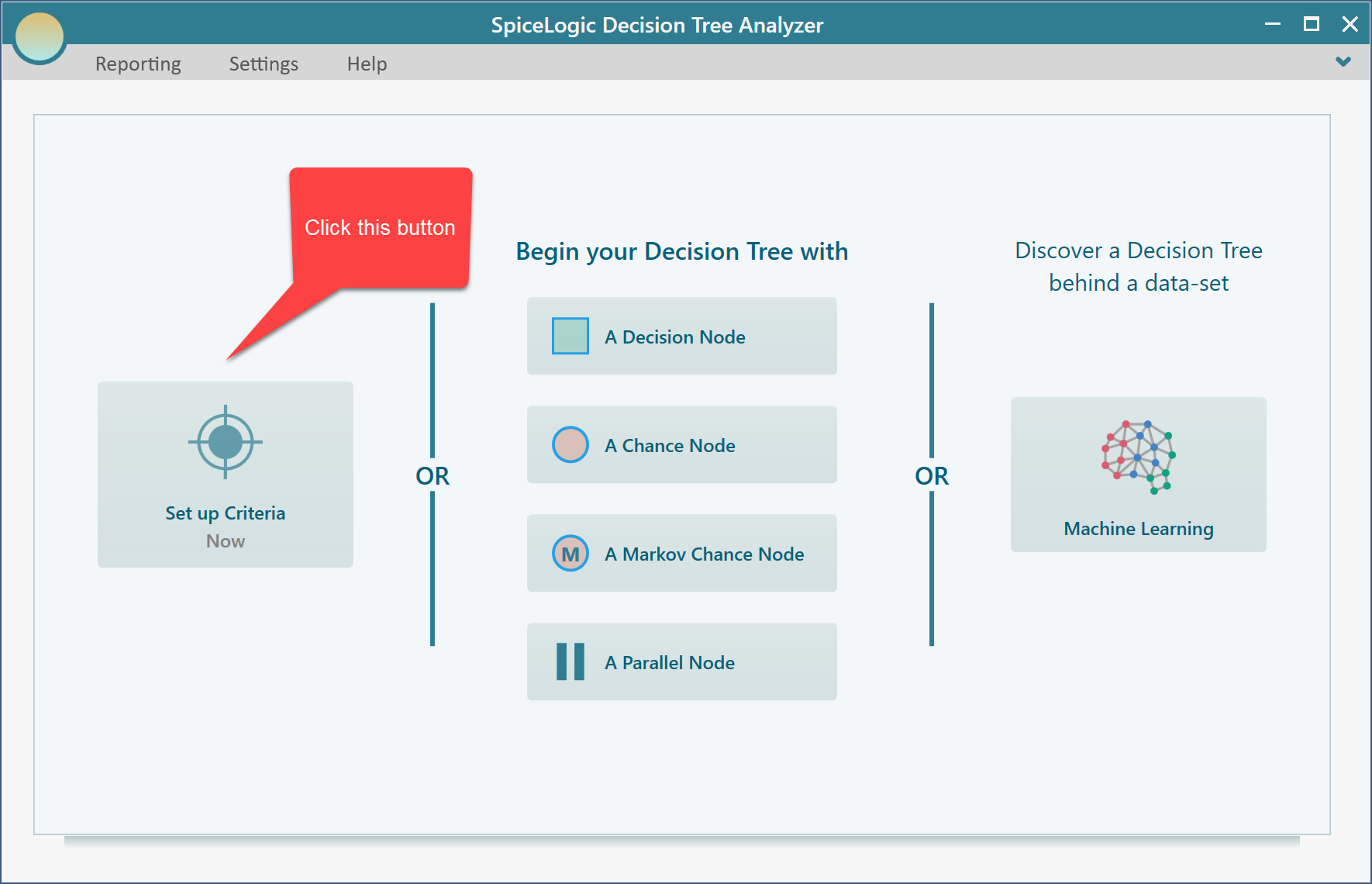

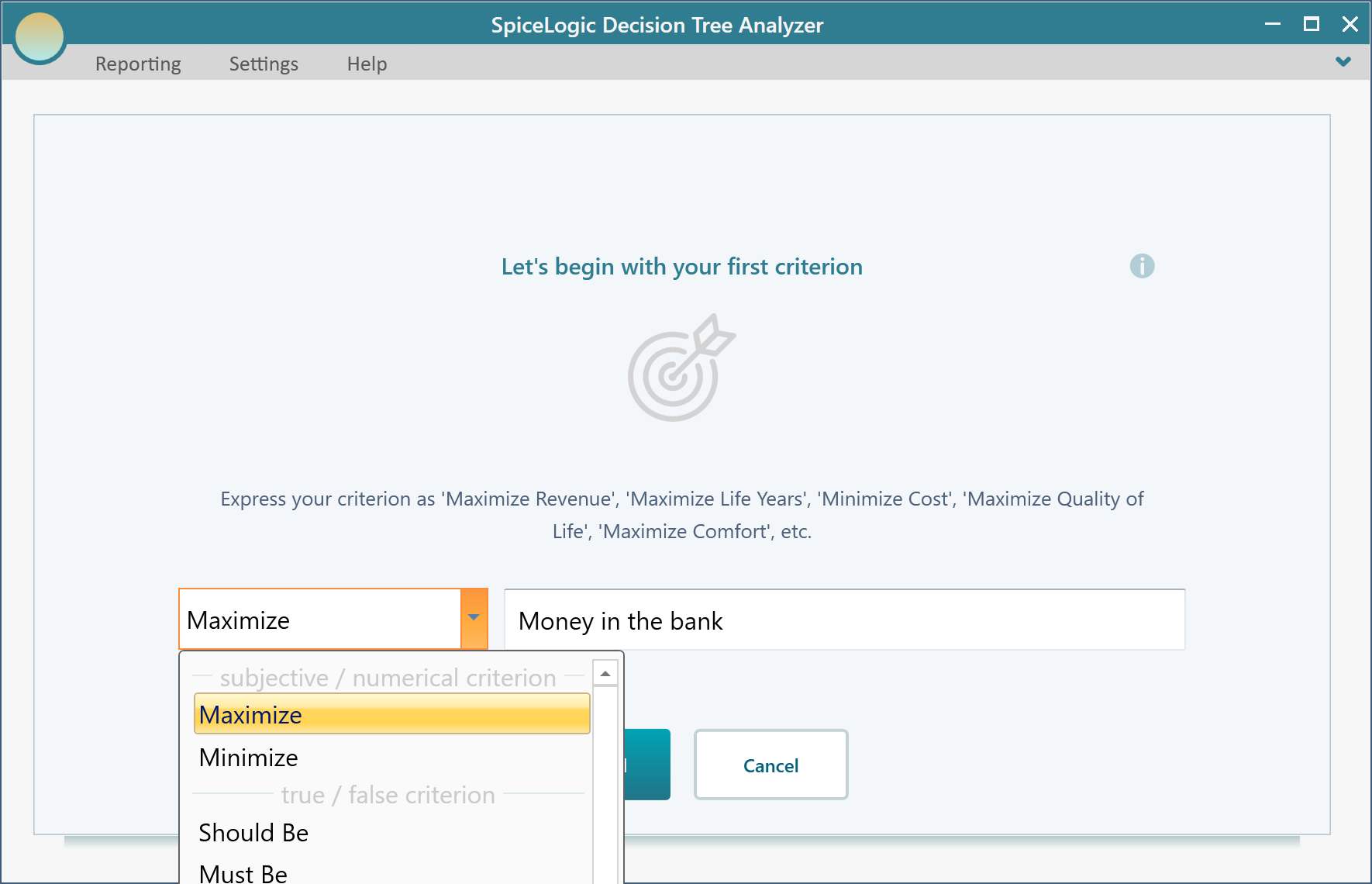

Start the "Decision Tree Software" software. Then, click "Set up Criteria".

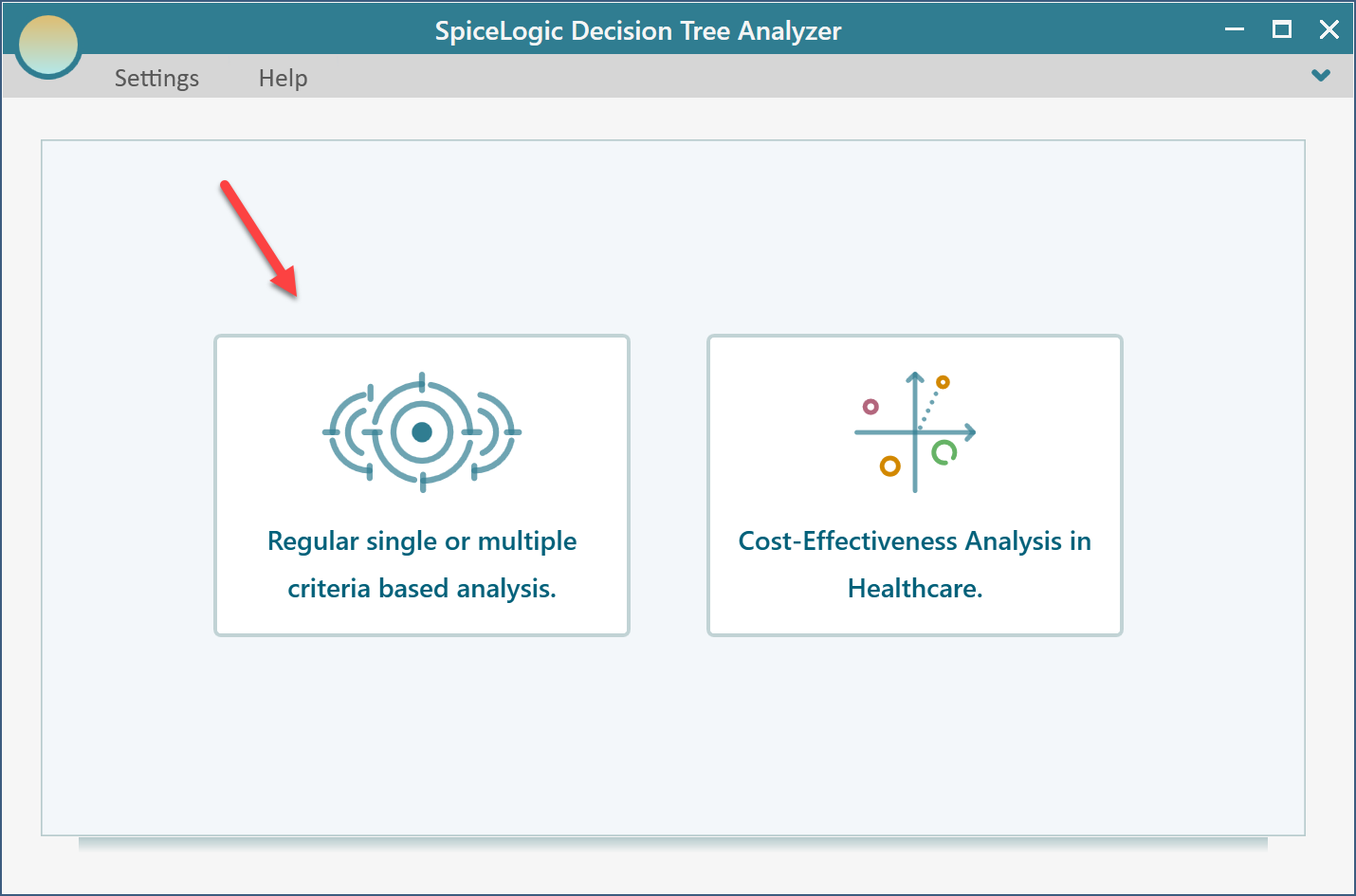

Once you click that button, you will be asked, if you want to use a regular single/multiple criteria analysis or a Cost-Effectiveness analysis. Choose the first option.

Once you click that button, you will be asked, if you want to use a regular single/multiple criteria analysis or a Cost-Effectiveness analysis. Choose the first option.

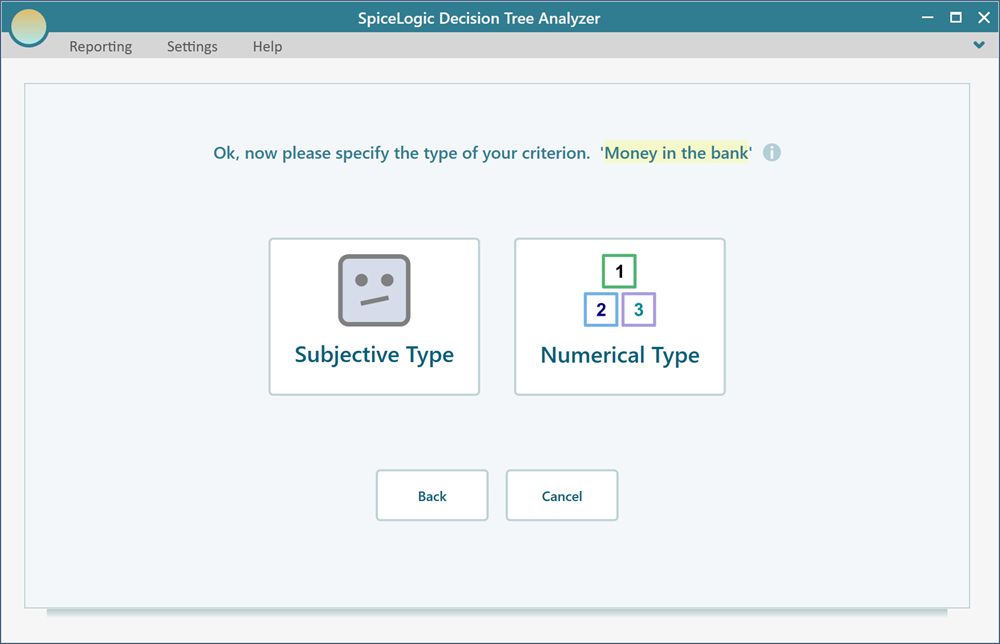

Then click the "Proceed" button. You will be asked about the type of criterion. Select "Numerical Type". Please remember that, in order to use a Utility function, you need to use the Numerical type criterion.

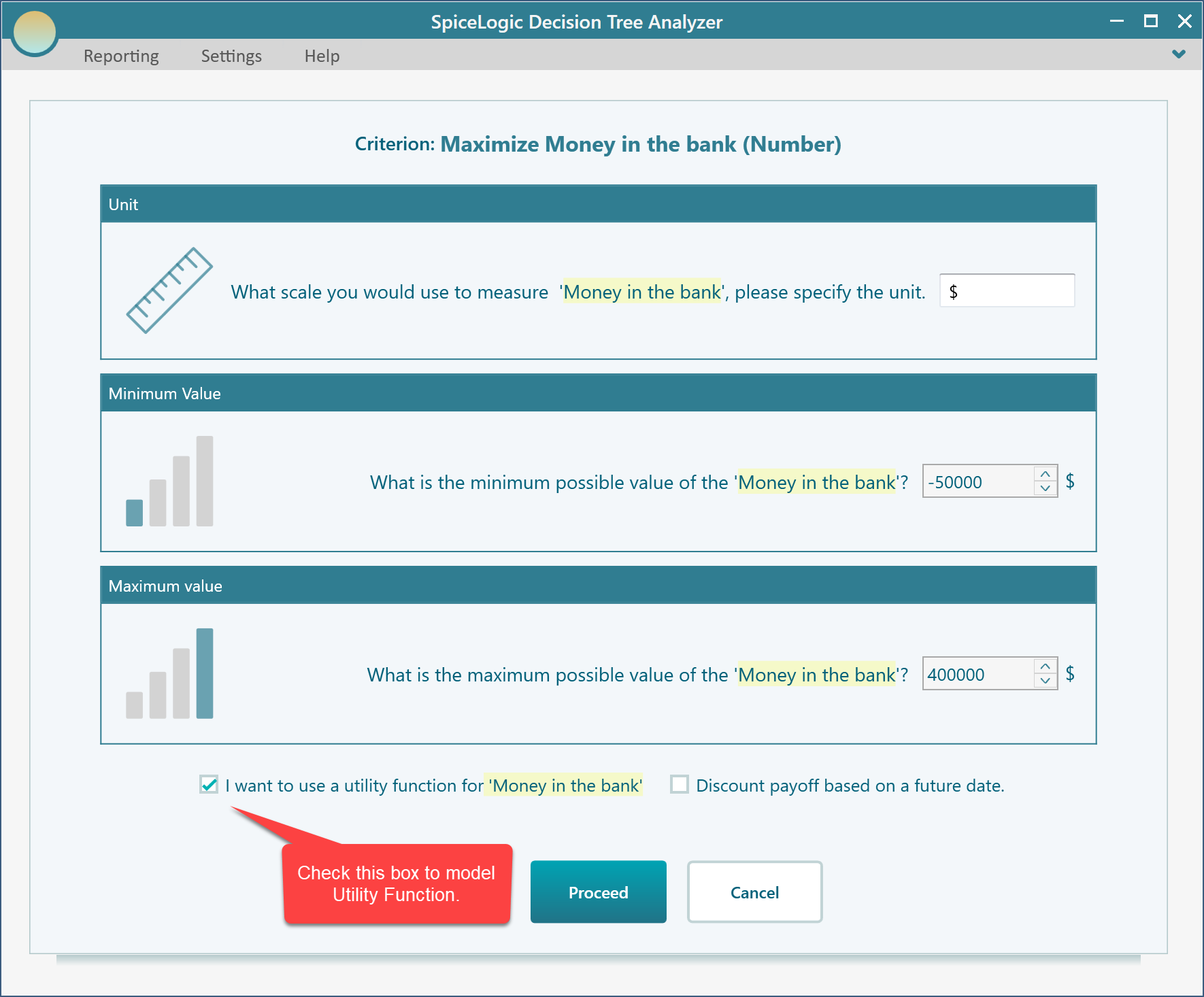

Then you will be asked to enter the Minimum and the Maximum possible value of the "Money in the bank" from this decision context. Enter Minimum = -50,000 and Maximum = 400,000. Set Unit = $ (or any currency you prefer. That unit value has no impact on the calculation. It is just for the display purpose)

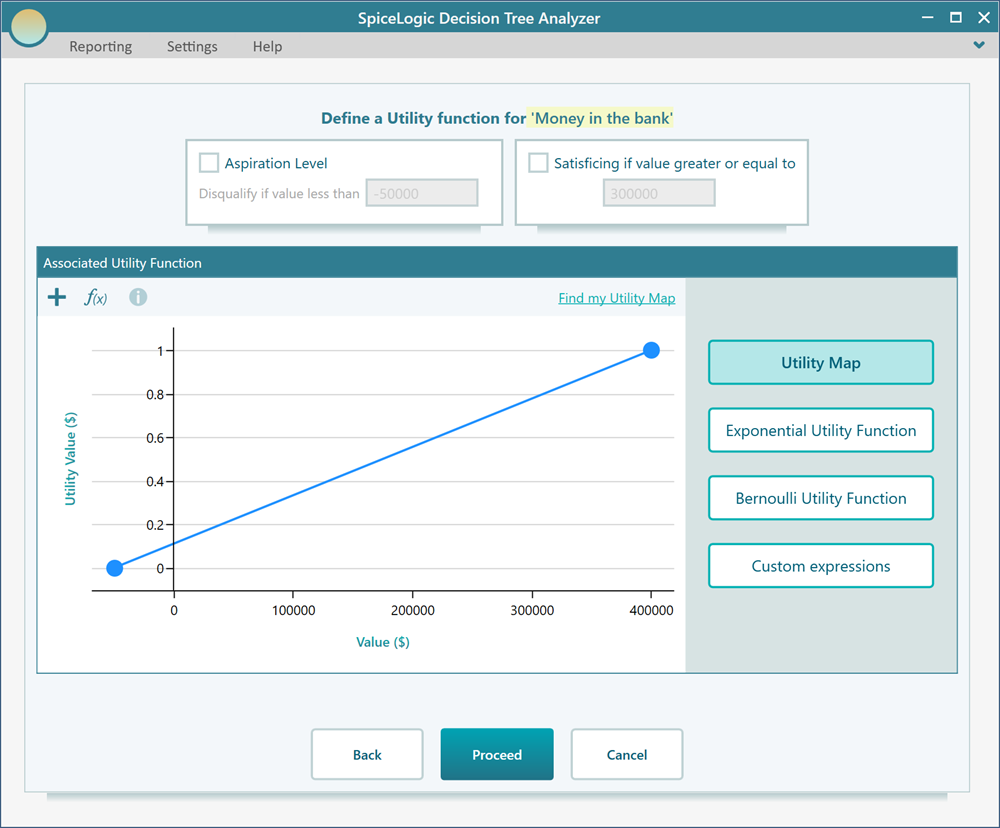

Then, when you click to proceed, you will see the utility function editor. The utility function editor lets you define a utility function in various ways. The easiest way is to use the visual drag and move builder as shown below.

You can double-click on the Chart Panel to add a utility point. You can use Mouse drag and move to move any utility point in any direction you want. Finally, add some utility points and move them as shown in the following screenshot.

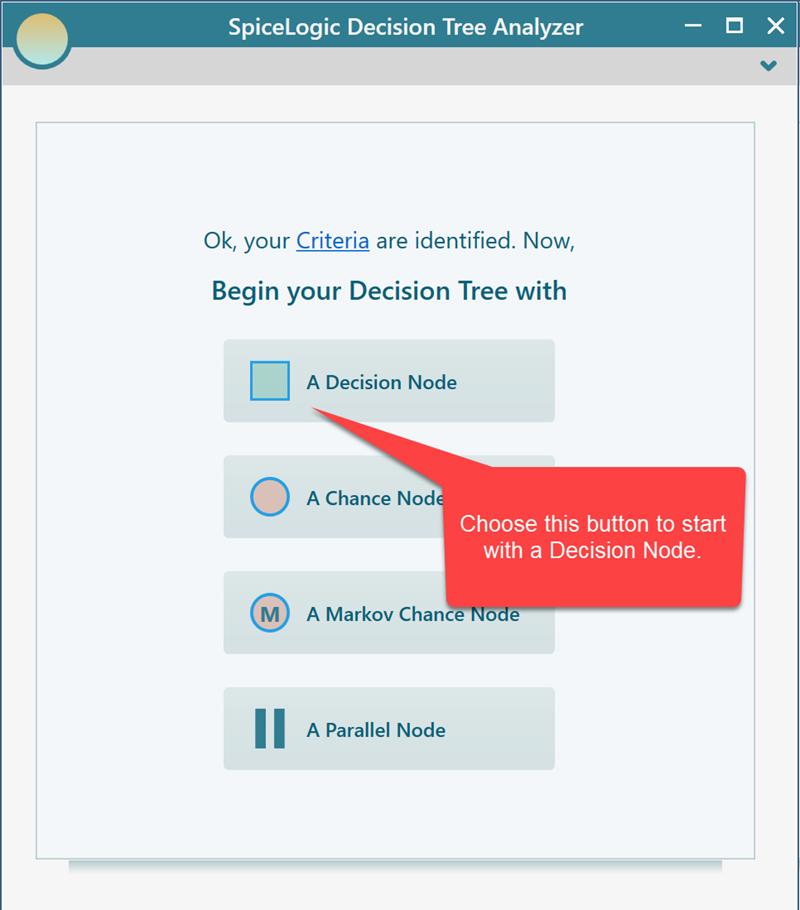

Then click proceed. You will be asked if you want to add another criterion. Just answer "No" and then, you will be taken to the Decision Tree start page.

Once you click that "Decision Node" button, you will be taken to the Decision Tree diagram page. Learn how to use the Decision Tree tool from this page. Create a Decision Tree as shown in the following screenshot.

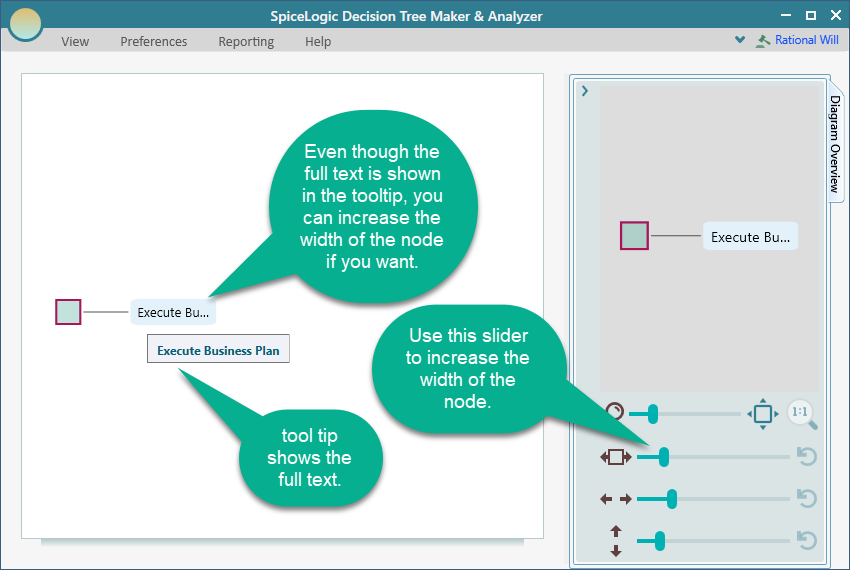

We have explained that you can change the Diagram aesthetics. Here is a quick tip.

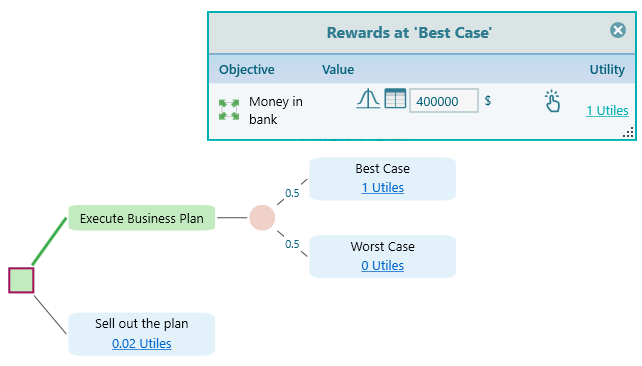

Anyway, select the "Best Case" node and attach a reward of 400,000$.

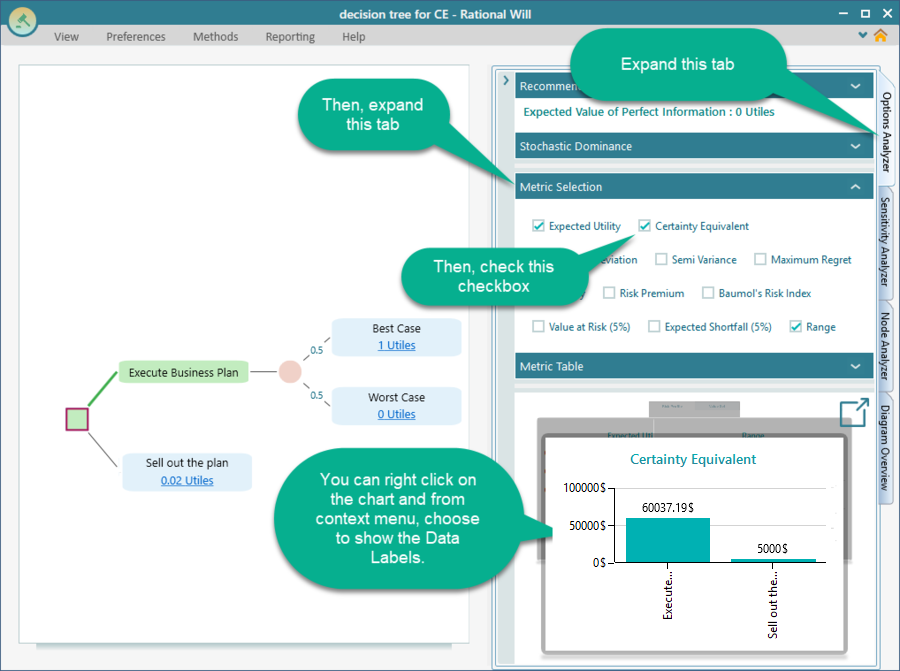

Same way, attach a reward to the Worst-Case as -50,000. Also, select the node "Sell out the plan" and attach a reward = 5,000$ which your friend proposed to you. Then expand the "Options Analyzer" tab. Within the Options Analyzer, you will see a section named "Metric Selection". Expand that tab. Within that Metric Selection panel, check the checkbox "Certainty Equivalent"

From the Certainty Equivalent Chart, you can see that the "Certainty Equivalent" value for the "Execute Business Plan" option is 60,037$, which is close to what we saw in the Utility chart.

From the Certainty Equivalent Chart, we can see that the Certainty Equivalent for "Executing Business Plan" is much higher than the value for Selling out the business at 5000$. So, if you stick to the same utility function, then you should not sell out the business plan. You can sell if you can get almost 60,000$ for the plan.